State Bank of India, is one of the leading government banks of India which is fully utilizing technology and giving best customer services. Its not only a bank of common man but also of those who are tech savvy and don't want to go for private banks due to their higher charges.

Recently SBI (State Bank of India) has provided a facility of Virtual Card. Any body with a bank account in SBI, whose internet banking is activated, can use this facility. Virtual Card is a major breakthrough to stop Online Banking Frauds.

SBI Virtual Card is not a physical card, so it cannot be used at ATMs to withdraw money. Virtual Card is for making online payments. You can create a virtual card with a shopping limit ranging from Rs 100 to Rs 50,000 . Once this card is used then it can't be used second time. So it removes the fear of being used second time by any body. By using this SBI virtual card you don't have to reveal your actual credit/ debit card details on a shopping website.

Yes, SBI Virtual Card is designed to make the online transactions safer for you. All aspects of online shopping are kept in mind by SBI while providing this facility to its customers. While you are creating a card by using your net banking service, you will receive a OTP (One Time Password) to complete the process. Similarly you will also receive a OTP while you are doing a transaction. So even if somebody has stolen your virtual card details, he/she will not be able to use it, as OTP is provided on your registered mobile number. Once you have used the SBI Virtual Card and financial transaction is done, then this card can't be used next time. This card is automatically cancelled after one transaction. If you don't use SBI Virtual Card within 24 to 48 Hrs of its creation, then its automatically cancelled.

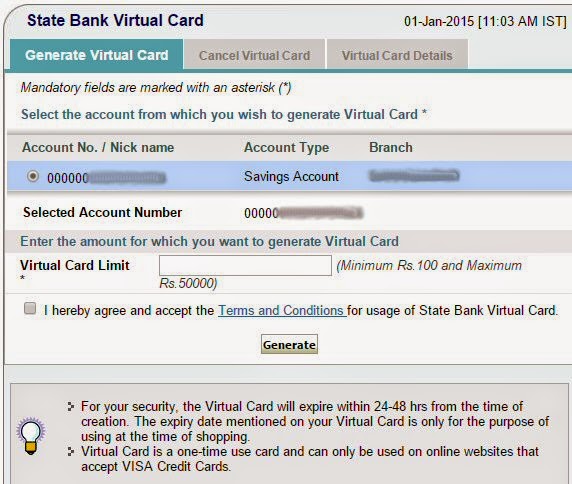

To create a Virtual Card in SBI, you should have your SBI Netbanking activated. Once you are logged in to your net banking account , you can go to "eCards" menu to create a virtual account.

After creation of this SBI Virtual Card you will get all details to use it, such as card number, expiry (MM/YY) and CVV code.

To complete the SBI Virtual Card Creation process you will receive a OTP on your registered mobile number.

Yes there are certain limitations. These Limitations are provided below.

Once you have created a virtual Card with X amount, then X amount is transferred into your virtual card account for shopping purpose. Once the shopping is done, the remaining amount in virtual card account is transferred back to your actual account. If the shopping is not done then virtual card account is cancelled after 48 hrs of creation and all amount is returned back to actual account. You can also cancel the SBI Virtual card account manually before the 48 hrs period. No extra amount is debited from your account

Recently SBI (State Bank of India) has provided a facility of Virtual Card. Any body with a bank account in SBI, whose internet banking is activated, can use this facility. Virtual Card is a major breakthrough to stop Online Banking Frauds.

What is a SBI Virtual Card ?

SBI Virtual Card is not a physical card, so it cannot be used at ATMs to withdraw money. Virtual Card is for making online payments. You can create a virtual card with a shopping limit ranging from Rs 100 to Rs 50,000 . Once this card is used then it can't be used second time. So it removes the fear of being used second time by any body. By using this SBI virtual card you don't have to reveal your actual credit/ debit card details on a shopping website.

Is it Safe to use SBI Virtual Card ?

Yes, SBI Virtual Card is designed to make the online transactions safer for you. All aspects of online shopping are kept in mind by SBI while providing this facility to its customers. While you are creating a card by using your net banking service, you will receive a OTP (One Time Password) to complete the process. Similarly you will also receive a OTP while you are doing a transaction. So even if somebody has stolen your virtual card details, he/she will not be able to use it, as OTP is provided on your registered mobile number. Once you have used the SBI Virtual Card and financial transaction is done, then this card can't be used next time. This card is automatically cancelled after one transaction. If you don't use SBI Virtual Card within 24 to 48 Hrs of its creation, then its automatically cancelled.

How to create Virtual Card in SBI ?

To create a Virtual Card in SBI, you should have your SBI Netbanking activated. Once you are logged in to your net banking account , you can go to "eCards" menu to create a virtual account.

After creation of this SBI Virtual Card you will get all details to use it, such as card number, expiry (MM/YY) and CVV code.

To complete the SBI Virtual Card Creation process you will receive a OTP on your registered mobile number.

Are there any limitations on SBI Virtual Card ?

Yes there are certain limitations. These Limitations are provided below.

- You can't use SBI Virtual Card in ATMs to withdraw money as its not a physical plastic card.

- You can make transaction only upto a maximum limit of Rs 50000.

- You can not use the same SBI Virtual Card twice. You have a create a one more virtual card if you want to shop more.

- You can only use it for online shopping where VISA / Mastercard shopping is allowed.

- SBI Virtual Card can only be used for shopping in Indian Currency INR.

How is the money debited from my actual SBI account.

Once you have created a virtual Card with X amount, then X amount is transferred into your virtual card account for shopping purpose. Once the shopping is done, the remaining amount in virtual card account is transferred back to your actual account. If the shopping is not done then virtual card account is cancelled after 48 hrs of creation and all amount is returned back to actual account. You can also cancel the SBI Virtual card account manually before the 48 hrs period. No extra amount is debited from your account

No comments:

Post a Comment